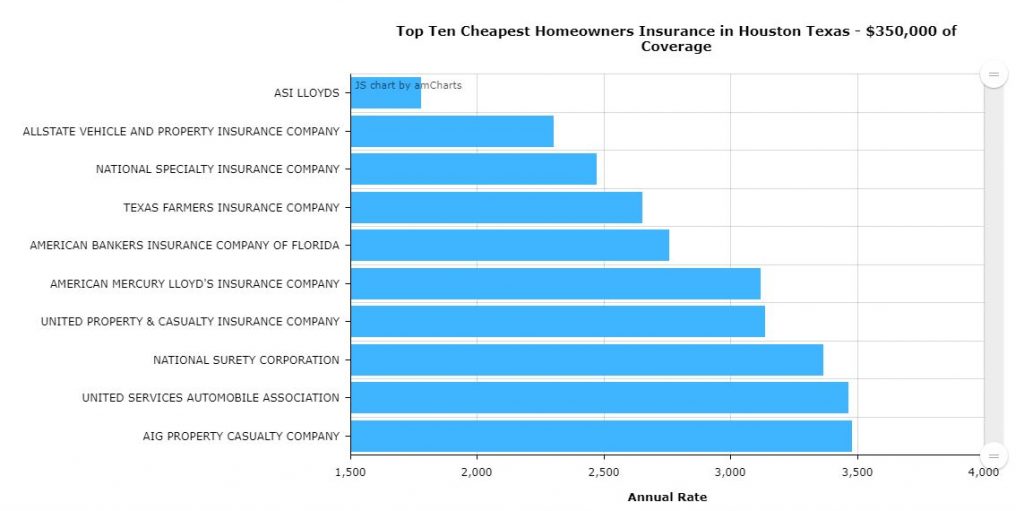

Average Cost of the Top Ten Homeowners Insurance Companies in Houston

In this case study, we collected homeowner insurance rates from all zip codes to find the average cost of homeowners insurance in Houston. The data is Current for March 2022 and is for a person seeking $350,000 of coverage and claim-free for five years. In addition, they have an average credit rating, the type of construction is brick veneer, and the age of residents is 10 to 34 years old.

ASI Lloyds

ASI homeowners policies cover most risks, such as theft, lightning, fire, contents, and loss of use. In addition, the replacement-value range is standard, as is coverage for medical payments and personal liability. Furthermore, additional options are available for art, jewelry, and personal injury items. From our study, ASI Lloyds has the cheapest average cost of homeowners insurance in Houston.

Allstate Vehicle and Property Insurance Company

Allstate offers affordable coverage for both traditional houses and mobile homes, including flood insurance, personal umbrella policies, and more. The standard homeowners’ policy covers most risks, such as fire, theft, vandalism, lightning strikes, and replacement cost coverage. In addition, flood insurance is available, as are several innovative riders.

Allstate’s multi-policy discount offers a discount when combined with other add-ons. These add-ons include the claim-free discount, claim rate guard, easy pay plan, and retired discount at 55.

National Specialty Insurance Company

National Specialty Insurance Company is one of three insurance companies that operate through State National in Bedford, Texas. Although we reference them on our website, the company doesn’t have a website.

They primarily serve the Dallas-Fort Worth area and have only a telephone number listed for customer service. Texas Quotes list them as providers of homeowners insurance and several other types. However, additional information is available only by calling the listed phone number 1-800-877-4567.

Texas Farmers Insurance Company

Farmer’s Insurance in Texas offers flexible homeowners insurance policies to meet almost any budget. Standard coverages include personal property, replacement cost without depreciation, medical payments for injured guests, and additional expenses. Additional living expenses can extend for two years if the house becomes uninhabitable.

One policy can cover all structures on the property and includes acts of nature such as wind and fire. A suitable carrier also includes vandalism. However, there may be exclusions. Policyholders can have coverage for structures worldwide. Insurance companies do not limit it to Texas or the U.S. Optional coverages can include an identity shield and scheduled and unscheduled coverage for valuables such as art and jewelry.

American Bankers Insurance Company of Florida

American Bankers Insurance Company of Florida operates in Florida under the name of Assurant, has been in business since 1947, and provides mobile home insurance. Policies available include damage from earthquakes, flood, hurricane, tornado, theft, vandalism, lightning, and hail.

Replacement cost coverage without depreciation is available in most states and includes the dwelling and the contents. In addition, adjacent structure coverage is available, as is personal liability protection.

American Mercury Lloyds Insurance Company

American Mercury Insurance offers a comprehensive homeowners insurance policy that is customizable for almost anyone. Dwelling protection covers damages caused by fire and smoke, storm or lightning, wind, and other acts of nature. Furthermore, actual replacement cost coverage is available for up to 150 percent of the policy limits. Moreover, personal property is covered, as are additional living expenses if the home is uninhabitable.

Personal liability and guest medical payments are included in the policy, as is identity theft. Also, additional coverage is available for valuables such as art and jewelry.

United Property & Casualty Insurance Company

United Property & Casualty Insurance has a comprehensive package for homeowners, whether they live in a house or a condominium. In addition, standard coverages include the primary structure, loss of use, personal property, and personal liability.

Optional coverages include identity theft protection and restoration, art and jewelry insurance, equipment breakdown, and water damage. Moreover, policy limits, scopes, and exclusions vary by geographic area, and some coverages may not be available in some markets.

National Surety Corporation

National Surety Corporation is a subsidiary of Firemen’s Fund, founded in 1954; they operate from Novato, CA. They provide surety bonds and fidelity bonds and are a privately held company.

United Services Automobile Association

USAA offers homeowners insurance to both military and civilians. Also, they cover structures at replacement value without depreciation, and most weather-related events are covered. In addition, USAA in Houston covers vandalism, theft, and fire. In addition, identity theft coverage is available. Furthermore, USAA also includes the replacement cost of uniforms for active duty service members. Customers may file claims on their mobile app, and a multi-policy discount is available.

AIG Property Casualty Company

AIG’s comprehensive homeowners’ insurance provides 200 percent of replacement value on a rebuilt home in the exact location. Landscaping coverage is available, and insurance also covers sewer and drain damage. In addition, The insurance company can cover extra living expenses, identity theft, and scheduled expenses.

Coverage for updated technology to prevent a recurrence is available, as is condominium upgrade coverage.

USAA General Indemnity Company

USAA General Indemnity Company provides a variety of insurance offerings to USAA members. In addition, these include homeowners insurance, renters insurance, valuable personal property insurance, and others. Homeowners insurance offers coverage against many types of damage caused by nature; flood insurance is available as a separate policy.

Homeowners’ coverage includes damage from fire, vandalism, storms, theft, and vandalism. In addition, an identity theft add-on is available, as is protection for valuables.

Average Cost of Homeowners Insurance in Houston

| Company | Annual Amount | A.M. Best Rating |

|---|---|---|

| ASI LLOYDS | $1777 | A |

| ALLSTATE VEHICLE AND PROPERTY INSURANCE COMPANY | $2300 | A+ |

| NATIONAL SPECIALTY INSURANCE COMPANY | $2468 | A |

| TEXAS FARMERS INSURANCE COMPANY | $2649 | A |

| AMERICAN BANKERS INSURANCE COMPANY OF FLORIDA | $2757 | A |

| AMERICAN MERCURY LLOYD’S INSURANCE COMPANY | $3115 | A- |

| UNITED PROPERTY & CASUALTY INSURANCE COMPANY | $3134 | |

| NATIONAL SURETY CORPORATION | $3365 | A+ |

| UNITED SERVICES AUTOMOBILE ASSOCIATION | $3464 | A++ |

| AIG PROPERTY CASUALTY COMPANY | $3478 | A |

| USAA GENERAL INDEMNITY COMPANY | $3507 | A++ |

| GARRISON PROPERTY AND CASUALTY INSURANCE COMPANY | $3507 | |

| USAA CASUALTY INSURANCE COMPANY | $3507 | A++ |

| AMICA MUTUAL INSURANCE COMPANY | $3516 | A++ |

| TEXAS FAIR PLAN ASSOCIATION | $3621 | |

| CONSOLIDATED LLOYDS | $3835 | |

| NATIONWIDE GENERAL INSURANCE COMPANY | $3842 | A+ |

| TRAVELERS HOME AND MARINE INSURANCE COMPANY, THE | $3883 | A++ |

| METROPOLITAN LLOYDS INSURANCE COMPANY OF TEXAS | $4116 | A |

| AUTO CLUB INDEMNITY COMPANY | $4538 | A+ |

| CHUBB LLOYDS INSURANCE COMPANY OF TEXAS | $4679 | A++ |

| AMERICAN SECURITY INSURANCE COMPANY | $4691 | A |

| UNITRIN SAFEGUARD INSURANCE COMPANY | $4797 | A- |

| TEXAS FARM BUREAU MUTUAL INSURANCE COMPANY | $5832 | A- |

| LIBERTY INSURANCE CORPORATION | $6079 | A |

| STATE FARM LLOYDS | $6345 | B++ |

| ENCOMPASS INDEMNITY COMPANY | $6503 | A+ |

| SAFECO INSURANCE COMPANY OF INDIANA | $6914 | A |

Now that you know the average cost of homeowners insurance in Houston, why wait? Get a quote today and start saving money while you protect your home against the worst possible outcome.

Comments are closed.